Forex and Sector Cryptocurrency Evaluate

The international exchange sector - also known as the forex or forex industry - is among the most intensely traded industry on the globe, which has a turnover of $five.1 trillion a day*.

To put this in perspective, the U.S. stock market trades about $257 billion a day; a fairly large sum, but only a fraction of what is traded in the foreign exchange market.

The foreign exchange market trades 24 hours a day, 5 days a week, through banks, institutions and individual traders around the world. Unlike other financial markets, there is no centralized market for Forex, currencies are traded on whichever market is open at the time.

How foreign exchange trading works

Foreign exchange trading involves the simultaneous buying of one currency and selling of another. In the foreign exchange market, traders attempt to make profits by buying and selling currencies, actively speculating on the direction currencies may take in the future.

Want to know more about how to trade the forex market?

Our free Getting to Know Forex guide will cover how to get started, help you make your first trades and tell you how to create a long-term trading plan for long-term success.

*Average daily volume of the interbank foreign exchange market in April 2016, according to the Bank for International Settlements.

What is a cryptocurrency?

A cryptocurrency is a decentralized, digitally encrypted currency that is not connected to or controlled by any government or central bank, unlike traditional currencies such as the U.S. dollar (issued by the Federal Reserve), the euro (European Central Bank) or the Japanese yen (Bank of Japan), among many others.

Like these traditional currencies, cryptocurrencies typically serve two main functions:

Payment systems for goods and services.

Speculative instruments for trade and investment.

Popular cryptocurrencies:

- Bitcoin- Since its inception in 2009, Bitcoin has rapidly grown in importance as the world's first and most popular cryptocurrency.

- Litecoin - Released in 2011, Litecoin is largely made use of to be a payment transaction cryptocurrency that has been termed "the silver to Bitcoin's gold."

- Ethereum - Launched in 2015, Ethereum has speedily acquired level of popularity within the heels of Bitcoin, and at this time incorporates a market place capitalization 2nd only to Bitcoin amongst cryptocurrencies.

- Ripple - Made in 2012, Ripple differs from Bitcoin in that it does not demand mining to generate the cryptocurrency.

- Dash - Introduced in 2014, Dash, or Digital Money, was to begin with referred to as "Darkcoin," and is exclusive in that it is considered a extremely nameless and secretive cryptocurrency that makes a speciality of pretty much untraceable transactions.

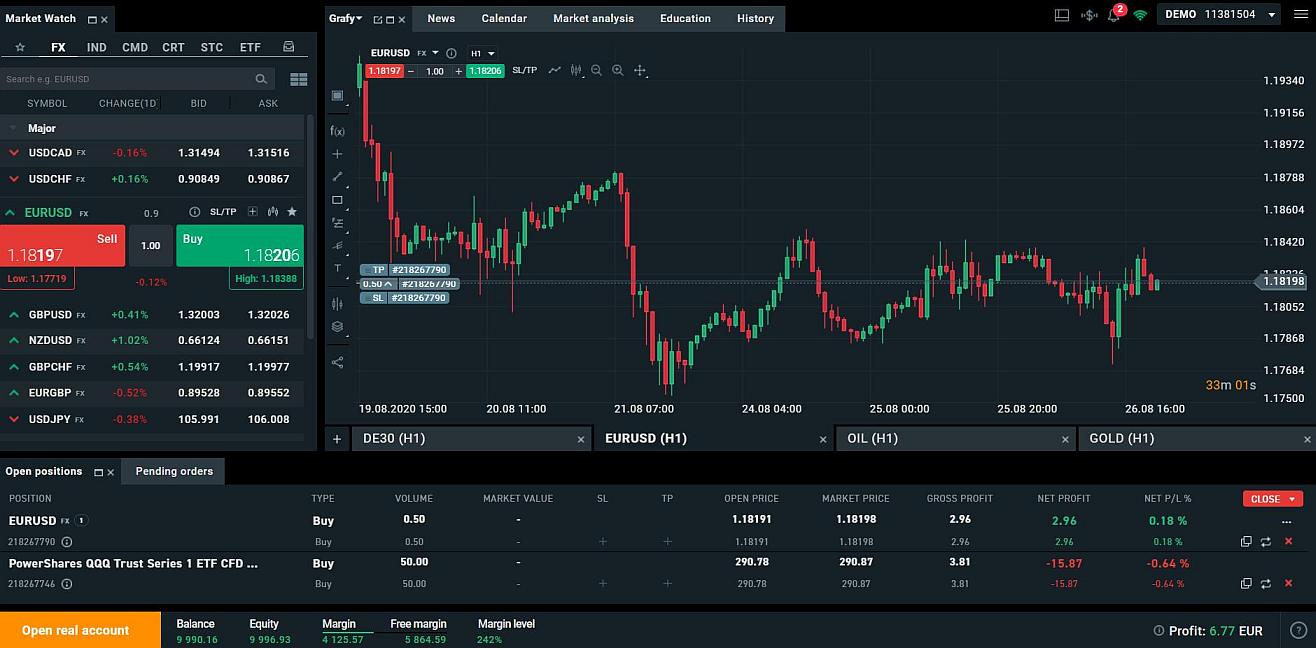

Orders are critical applications for any kind of trader and may always be considered when executing versus a trading tactic. Orders can be utilized to enter a trade in addition to to help secure income and Restrict downside possibility.

Being familiar with the discrepancies among the kinds of orders available can assist you pick which orders ideal accommodate your requirements and so are most effective suited to assist you to attain your trading goals.

Current market

A sector get is easily the most fundamental purchase sort which is executed at the top selling price offered at time the purchase is received.

Restrict

A limit get (also called a "consider revenue" get) can be an purchase to get or provide at a specified selling price or greater. A provide limit purchase is executed at or higher than the required value; invest in limit orders are executed at or under the desired price.

Limit order

Limit orders help you be really exact in defining the entry or exit issue of read more the trade. Note that Restrict orders do not assure entry or exit of the place, since if the specified cost is just not fulfilled, your buy will not be executed. A Restrict get which is connected to some now open up posture (or even a pending entry order) for the objective of closing that position may additionally be generally known as a "choose financial gain" purchase.

Cease

A end purchase triggers a sector order every time a predefined fee is achieved. A obtain quit order triggers a market place get when the bid cost is achieved; a provide prevent get triggers a marketplace order when the ask price is achieved. Both of those end orders are executed at the most beneficial out there rate, depending on available liquidity. Prevent orders, also referred to as cease-loss orders, will often be accustomed to limit draw back possibility.